Choose Your Subscription Plan

Choose the perfect subscription plan and unlock exclusive benefits tailored to your needs!

Basic

- Unlimited Calls

- Free Domain

- 100 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Professional

- Unlimited Calls

- Free Domain

- 200 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Advance

- Unlimited Calls

- Free Domain

- 400 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Basic

- Unlimited Calls

- Free Domain

- 100 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Professional

- Unlimited Calls

- Free Domain

- 200 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Advanced

- Unlimited Calls

- Free Domain

- 400 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Basic

- Unlimited Calls

- Free Domain

- 100 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Professional

- Unlimited Calls

- Free Domain

- 200 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Advance

- Unlimited Calls

- Free Domain

- 400 MB Of Storage Space

- 500 MB Bandwidth

- 24/7 Support

Ingredients You Can Trust

Our products feature high-quality, natural ingredients for your peace of mind and well-being.

Lobster Risotto

Beef Wellington

Orange Juice

Apple Juice

Pineapple Juice

Mango Juice

Kiwi Juice

Peach Juice

Caesar Salad

Tuna Salad

Chickpea Salad

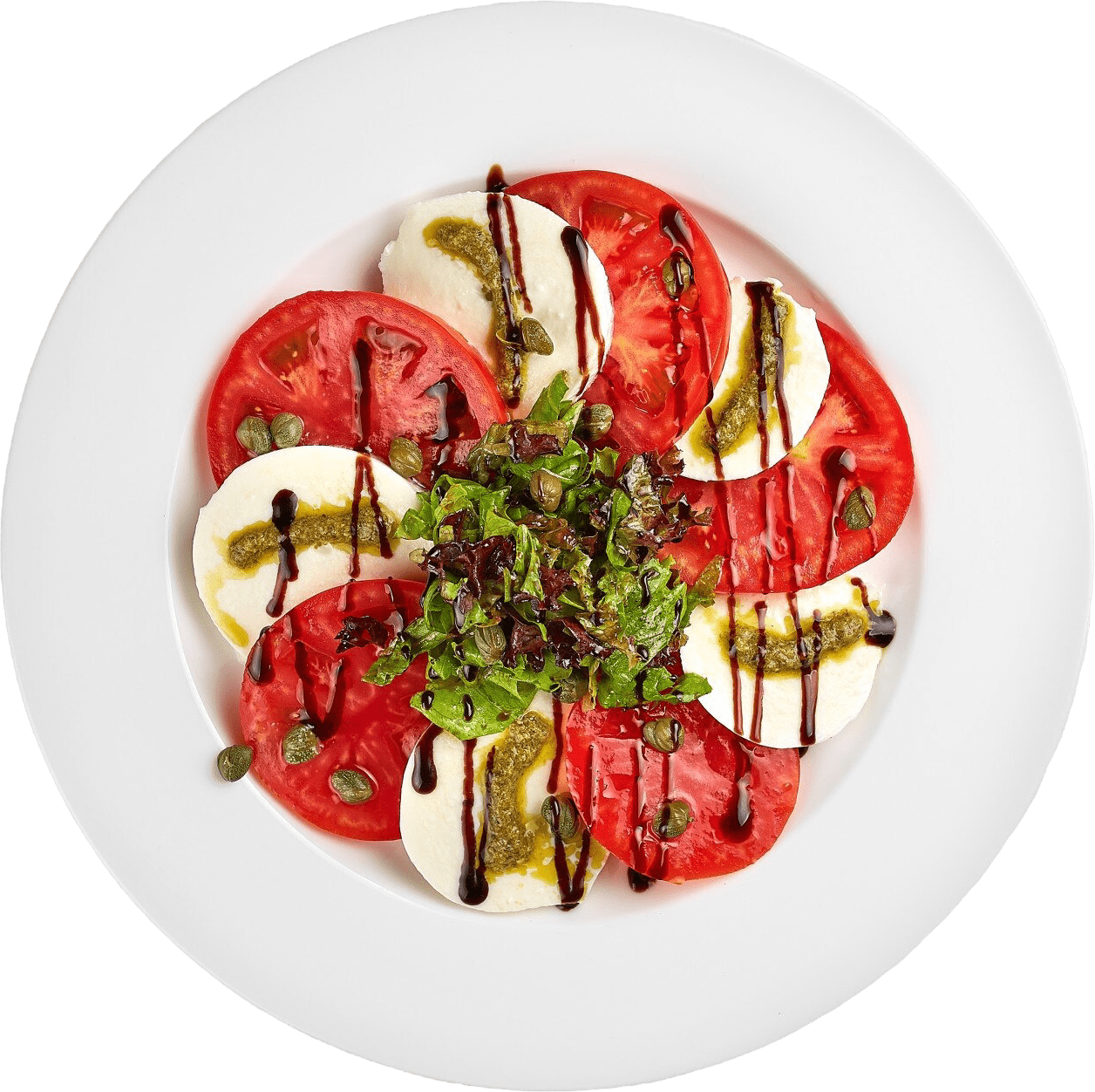

Caprese Salad

Quinoa Salad

Fruit Salad

Captured Moments With A Visual Journey

Experience the beauty of life’s highlights through stunning imagery and compelling stories.

Understanding Insurance Basics

Simplifying the essentials of coverage, policies, and protection to help you make informed decisions.

Car insurance is a contract between a vehicle owner and an insurance company that provides financial protection against risks and damages related to owning and operating a motor vehicle. In exchange for regular premium payments, the insurance company agrees to cover specific costs, such as repairs, medical bills, and liability claims, as outlined in the policy. Car insurance is a crucial aspect of responsible vehicle ownership, as it helps mitigate the financial impact of unexpected events like accidents, theft, or natural disasters, ensuring that drivers can stay protected and maintain their financial stability.

Health insurance is a type of insurance coverage that pays for medical, hospitalization, and surgical expenses incurred by the policyholder. It helps protect individuals from the high cost of healthcare by covering a portion of the expenses related to medical treatments, preventive care, prescriptions, and sometimes even mental health services. Health insurance policies can vary widely, depending on the provider, the level of coverage, and the specific needs of the policyholder, but their main function is to ensure that individuals and families have access to affordable healthcare when needed.

Life insurance is a financial product designed to provide financial protection and security to the policyholder’s loved ones after their death. It functions as a contract between an individual (the policyholder) and an insurance company, where the policyholder agrees to pay regular premiums, and in return, the insurance company provides a lump-sum payment known as the death benefit to the beneficiaries designated by the policyholder upon their death. The purpose of life insurance is to ensure that, when the policyholder passes away, their family, dependents, or loved ones are not left with significant financial uncertainty.

Our Team Members

Meet the dedicated professionals who bring expertise, passion, and collaboration to every project.

Jack Ryan

Emma Rose

Sila Lee

Lily Jane

Joseph Ray